Embark on a journey exploring the synergy between financial planning and health routines, uncovering the profound impact they have on each other. As we delve deeper into this dynamic relationship, you'll discover how aligning these two aspects can lead to a more balanced and fulfilling life.

In the following paragraphs, we will explore the benefits, strategies, and holistic approaches to integrating financial planning with health routines.

Benefits of Combining Financial Planning with Health Routines

Financial planning and health routines may seem unrelated, but they are actually closely intertwined. The way we manage our finances can have a significant impact on our health and well-being. By combining financial planning with health routines, individuals can experience a range of benefits that positively impact both areas of their lives.

Improved Stress Management

Financial stress is a common source of anxiety and can negatively affect physical and mental health. When individuals have a solid financial plan in place, they are better equipped to handle unexpected expenses and financial emergencies. This can reduce stress levels and contribute to overall well-being.

Healthy Lifestyle Choices

Integrating financial goals with health goals can lead to healthier lifestyle choices. For example, individuals who prioritize saving money for a gym membership or nutritious food are more likely to make positive health decisions. This alignment between financial and health objectives can result in improved physical health outcomes.

Access to Healthcare

Effective financial planning can ensure that individuals have the means to access necessary healthcare services. By budgeting for medical expenses and insurance coverage, individuals can prioritize their health and well-being without financial strain. This proactive approach to financial management supports overall health outcomes.

Reduced Risk of Health Issues

Financial stability can contribute to a reduced risk of health issues. Individuals who are financially secure are more likely to afford preventive healthcare measures, such as regular check-ups and screenings. By addressing financial goals alongside health goals, individuals can proactively manage their health and reduce the likelihood of developing serious health conditions.

Strategies for Aligning Financial Planning with Health Routines

Incorporating healthy habits into daily financial planning activities is essential for overall well-being. By aligning financial goals with health routines, individuals can prioritize both their physical and financial health. Here are some strategies to help you achieve this balance:

Setting Financial Goals that Support Overall Health

- Establish specific health-related financial goals, such as saving for gym memberships, nutritious food, or preventive medical care.

- Consider long-term health expenses, like insurance premiums, emergency funds for unexpected medical costs, and retirement savings for healthcare needs.

- Align financial goals with personal health objectives, such as weight loss, quitting smoking, or improving mental well-being.

Creating a Budget that Prioritizes Financial Stability and Health Expenses

- Allocate a portion of your budget specifically for health-related expenses, such as gym memberships, healthy groceries, and medical appointments.

- Track your spending on health-related items to ensure that you are staying within your budget and making informed decisions about your financial health.

- Consider the impact of unhealthy habits on your finances, such as smoking or excessive drinking, and factor in the costs of breaking these habits into your budget.

Impact of Stress on Financial Planning and Health

Stress can have a significant impact on both financial planning and health. When individuals are under stress, they may make impulsive or irrational financial decisions that can have long-term consequences

Additionally, stress can also take a toll on physical and mental health, leading to issues such as high blood pressure, anxiety, depression, and other health problems.

Relationship between Stress, Financial Decisions, and Health Outcomes

Stress can cloud judgement and impair decision-making abilities, which can result in poor financial choices. For example, individuals under stress may overspend, neglect saving for the future, or invest in risky ventures without proper research. These decisions can lead to financial setbacks and increased stress levels.

Moreover, the constant worry and anxiety associated with financial problems can further exacerbate stress, impacting overall health outcomes.

Benefits of Stress Management Techniques

Implementing stress management techniques can help individuals improve both their financial planning and health. Techniques such as mindfulness, exercise, meditation, and deep breathing can help reduce stress levels, improve focus, and enhance decision-making abilities. By managing stress effectively, individuals can make more informed financial decisions, reduce impulsive behavior, and mitigate the negative impact of stress on their health.

Examples of Positive Influence of Stress Reduction

Reducing stress levels can positively influence financial planning and health routines in various ways. For instance, individuals who practice stress-reducing activities may find themselves more motivated to stick to a budget, save money, and invest wisely for the future. Additionally, lower stress levels can lead to better sleep quality, improved immune function, and overall well-being, which are essential for maintaining good health and productivity in managing finances effectively.

Creating a Holistic Approach to Financial and Health Management

Creating a holistic approach to financial and health management involves integrating various components to ensure overall well-being. It is essential to strike a balance between financial goals and health priorities to achieve a comprehensive view of one's overall wellness.

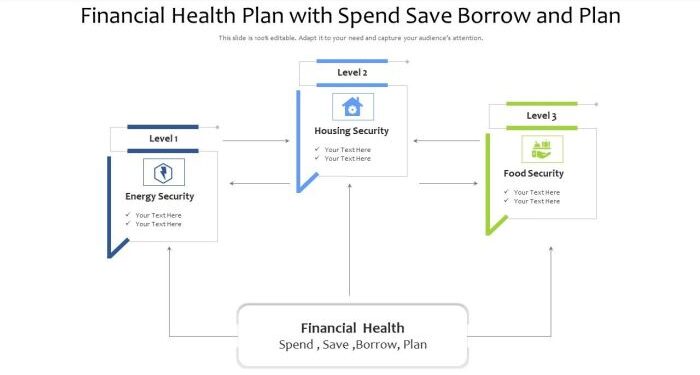

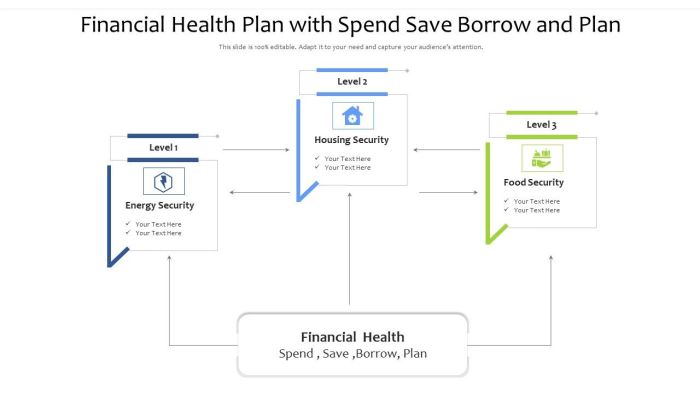

Components of a Holistic Approach

- Financial Planning: This includes setting financial goals, creating a budget, saving for the future, and investing wisely.

- Health Routines: Incorporating regular exercise, balanced nutrition, quality sleep, and stress management techniques into daily life.

- Mental Health: Prioritizing mental well-being through mindfulness practices, therapy, and self-care activities.

- Social Connections: Building and nurturing positive relationships with friends, family, and community for emotional support.

Importance of Balance

Maintaining a balance between financial goals and health priorities is crucial for long-term well-being. Neglecting one aspect can have a ripple effect on the other, leading to increased stress, health issues, or financial instability. By aligning both areas, individuals can lead a more fulfilling and sustainable lifestyle.

Strategies for Comprehensive Well-being

- Developing a holistic plan that addresses both financial and health goals simultaneously.

- Regularly reviewing and adjusting the plan to accommodate changing circumstances or priorities.

- Seeking professional advice from financial planners, health experts, or therapists to ensure a well-rounded approach.

- Practicing mindfulness and self-reflection to stay attuned to the needs of both body and wallet.

Final Review

In conclusion, by intertwining financial planning with health routines, individuals can pave the way for a harmonious existence where both wealth and well-being are nurtured simultaneously. Embracing this interconnected approach can truly transform one's life for the better.

Popular Questions

How does financial planning impact health routines?

Financial planning provides a sense of security and stability, reducing stress levels and allowing individuals to focus more on their health routines.

What are some tips for aligning financial goals with health goals?

Setting specific and achievable financial goals that support overall health objectives can ensure a balanced approach towards well-being.

How can stress affect both financial planning and health?

High levels of stress can lead to poor financial decisions and health outcomes, emphasizing the need for effective stress management techniques.

What components are essential in creating a holistic approach to financial and health management?

Balance, integration, and prioritization are key components of a holistic approach that considers both financial planning and health routines.